Digital transformation: reinventing retail banking

Podcast (english): Play in new window | Download (Duration: 7:44 — 5.0MB)

Subscribe: Apple Podcasts | Spotify | Android | Blubrry | Email | RSS

With digital transformation, the retail banking marketMarket definition in B2B and B2C - The very notion of "market" is at the heart of any marketing approach. A market can be defined... is being completely reconfigured. New players are entering the market and new expectations are high. Hence, retail banks need to change the way they operate. They should try and adapt to this transforming market, and maintain their ability to grow. Digital transformation is at the core of this challenge. Let us see why, how, and where all this will lead. In this piece I will emphasise the importance of the fine-tuning of the banking customer experience and business model changes.

Digital transformation: reinventing retail banking

The impact of digital on retail banking and consumers

With regard to the banking sector, digital is considered a path of natural evolution rather than a path of revolution. This is due to the fact that information systems have already played a strategic role in the dematerialisation of banking processes for a long time.

Nevertheless, retail banks must enrol in this large digital transformation process, to readjust to the new characteristics of the market. Such changes are happening in four areas:

- Customer experience optimisation

- Shift in operational processes

- Change in internal processes

- Reshaping of business models

The current model of retail banking is based on a physical network of branches offering a complete panel of banking services. This model is outdated because both of its cost and the lack of customer satisfaction it produces. Although the resizing of retail networks could help reduce operating costs, this would not be sufficient for financial institutions to better comply with new market conditions.

Retails Banking Consumers’ New Expectations

Let’s start with the indirect impact of digital. Connected daily on at least one social network platform from a mobile phone, consumers have new expectations.

More interaction and a seamless relationship to start with, as well as an easier, simpler access to banking services, not to mention ease of use.

Consumers are increasingly reaching higher levels of digital integration from a personal point of view, and this leads to more demands which banks, just like other brands, need to address.

Branches opening hours are often incompatible with their clients’ working hours. Access to banking services and to personal requests via a financial advisor are perceived as unbelievably and unnecessarily complex by consumers in this day and age.

In the 1990s, banks did design new ways of addressing such requirements: call centres offered an opportunity of expanding working hours.

However, in a world where everything is accessible 24/7, this is no longer sufficient in the eyes of today’s customers of the banking sector.

Designing Simple Services Is a Really Complex Endeavour

Simplifying services is yet another challenge to overcome.

An American study on the emotional and the economic value of simplicity (Siegel, Gale, 2010, Global Brand Simplicity Index) completed on 6,000 consumers in Europe, North America, Asia and Middle East, revealed that banks and insurance companies are ranked as being the least ‘simple’ brands. They are even considered ‘complex’ and ‘opaque’.

The combination of two factors, permanent access and simplicity, should bring banks to rethink their distribution model using users’ experience.

Hence one of the issues regarding digital transformation is the shift from multichannel — the proliferation of access channels operating in silos — to an omnichannel strategy, based on the continuity of the bank’s relationship with its clients, regardless of the channel, the place, or hour of use.

Digital Transformation: Beyond Retail Banking

The nature of the bank/client interaction needs to be reconsidered as well.

The growth of digital in consumers’ daily lives leads to an important disintermediation factor. This phenomenon started in the tourism and travel industries, before spreading to a larger number of verticals.

When it comes to online digital access, consumers would rather manage day-to-day banking transactions with little or no added value, such as balance inquiries, money transfers, cheques or cash deposits, all by themselves.

Omnichannel in Mind

With omnichannel in mind, the preferred vehicles for carrying out such transactions are personal computers, mobile phones or ATMs. All these means are preferred to contacting support via a call centre.

In the USA, the cheque deposit process via mobile phones, barely a year after its launch by USAA, has been adopted very broadly by the population. This is understandable as completing the process only requires a photo and app.

Reinventing one’s client relationships or bringing proper added value to its clients isn’t that easy. As a result, banks are threatened by new entrants: telecom operators and the inevitable tech giants. Such as Google, Apple, Facebook and Amazon and one should not rule out Microsoft. As well as a flurry of innovative start-ups.

Fighting Against Disintermediation

To thwart this disintermediation phenomenon, they need to provide their clients with personalised advice and services. Such services should have high added value, regardless of the channel they use.

That being said, banks also need to drop their product-centred approach. They should replace it with a ‘customer centric’ approach, and adapt to the new standards of digital use.

Three Innovative Models for Digital Transformation in the Banking Sector

In a 2016 banking study, Accenture laid out three models allowing banks to differentiate themselves and reach growth. According to Accenture, these models should help banks double their annual revenue growth – going from 4% to 8% on average in developed markets – while reducing service costs by 20% or more.

The New Generation of Multichannel Banking

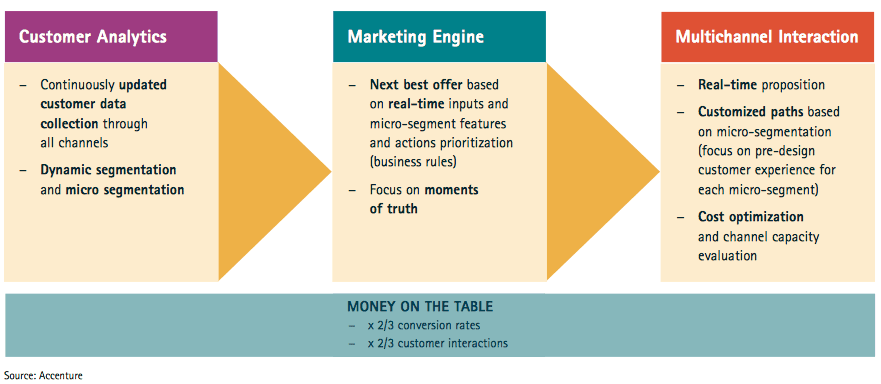

This model relies on a consolidation of the interactions in an omnichannel approach, in order to create a stronger relationship with clients and respond effectively to their needs.

This model relies on the use of analytical marketing techniques. It focuses on the personalisation of the bank/client relationship, and the eradication of organisational silos to shift from a multichannel to an omnichannel approach.

The new generation of multichannel banks – source: Accenture

Proactive banking through social media

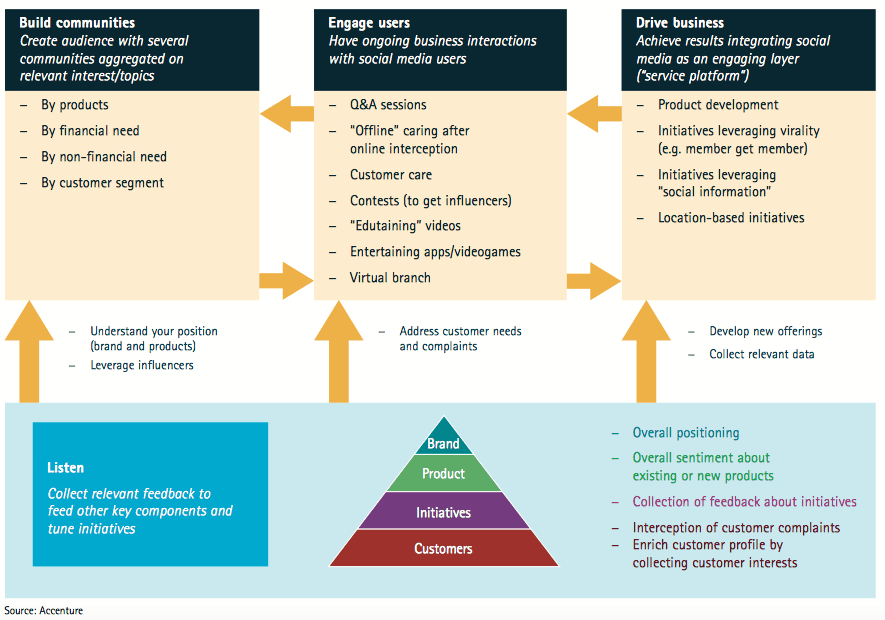

This model enables the bank to get closer to clients, wherever they are, through social media. Client interactions and support issues are therefore transferred to the bank’s consumers’ preferred media.

The bank is therefore able to understand their requirements in a much better way and focus on their demands (or those of the community).

On top of that, relationships turn into dialogue mode and social media makes it possible to engage in a co-creation process and make the most of the grassroots recommendations via influencers.

The Bank at the Core of the Digital Ecosystem

This model focuses on the power of mobile technology. The bank, being the privileged and trusted advisor of its clients, is therefore at the core of a solution-orientated sales ecosystem. Be it about financial services or not. And it is able to offer secure mobile payment services.

Great article Frédéric! The retail banking industry must evolve and embrace digital transformation efforts now if they wish to remain competitive. The increasing competition from more agile startups have made it necessary for traditional firms to constantly reposition their services. Looking forward to the next post in the series!

Thanks Jason, we are working on it.

And many more to come on the topic of digital transformation.