economics

-

digital marketing

Rule of three: More Competition Leads to Less Competition

today’s selection is a (very old post) dated 2006, taken from this very blog … More Competition Leads to Less Competition (rule of three) … in which I was commenting on a book entitled “the rule of three”. I realise that this analysis is still – or maybe more than…

Read More » -

Marketing & Innovation

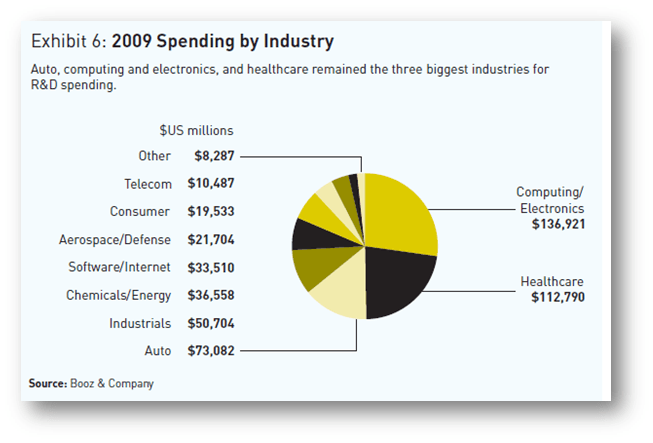

Booz Allen Global Innovation study shows rising R&D investments

The global innovation report is a yearly report showing R&D spendings and Innovation Investments across different industries. For reference, I have included the 2009 results by industry and the 2011 version below. The sectors which invest in R&D do not differ much from one year to another. Although the report states…

Read More » -

Web, Internet and the Economy

The love-hate relationship of Governments with Cyberspace

A few weeks ago I started contributing to the innovation generation blogs, an initiative sponsored by Alcatel. Here is my first piece entitled: Governments Ease Into Cyberspace. In October 2012 I took part in the Conference on Cyberspace, an event put together by the Hungarian government on behalf of the international…

Read More » -

Web, Internet and the Economy

Chinese Internet: the global battle has begun

The Chinese Internet is now conquering the world. In a previous series, Alban Fournier, a young French professional who fell in love with Asia warned us that China was the next worldwide International giant in the making. In this piece, he is expatiating on this previous report and delving into…

Read More » -

Marketing & Innovation

Despite appearances, red tape is good for business!

Red tape is good for business! So I read in an article published in the “briefing” section of Time magazine dated November 14, 2011 (“The Deregulation Myth: Ignore the rhetoric, nations with more rules grow faster). In this article, Time magazine have produced their own info-graphic from data taken from the World…

Read More »